The January sales are a crucial time for both retailers and consumers. As the expensive Christmas season comes to an end, shoppers usually look to maximise their budgets with large discounts, while businesses aim to clear inventory and boost revenue. This dynamic creates unique patterns in consumer behaviour that provide valuable insights into shopping habits and buyer preferences.

The shift in consumer behaviour is also highly influenced by digital changes. E-commerce platforms, PPC campaigns, mobile apps, and social media now play a pivotal role in how consumers discover and engage with post-holiday deals.

Let’s take a look at some stats on how past consumer behaviour in the January sales often looks, and some predictions for how this might pan out in 2025.

- In 2023, 43% of consumers said they were planning to cut down on discretionary spending due to rising household bills.

- Factors such as the January energy price cap rise in 2023, lead to increased worry among 87% of Britons about the impact on their finances.

- 46% of surveyed adults in the Public opinion and social trends bulletin reported plans to spend less on January sales shopping because of the rising cost of living.

- People also bought less clothes in January, with clothing stores sales volumes falling by 2.9% in January 2023

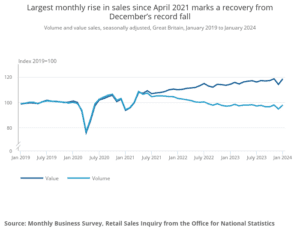

- The Office for National Statistics (ONS) said that the value of goods people bought in January 2024 went up 3.9%, compared to the 3.4% increase in the volume of products they purchased.

- There was a 3% increase in sales volumes of no and low alcohol beer volumes year on year

- Own-label ranges labelled as plant-based or vegan rose by 21% across the sector.

- Household goods stores rose by 1.8% in January 2024, which was mainly because of sales in hardware stores.

- Royal Mail saw a staggering 38% increase in activity in Jan 2024,, reaching 17.9 million transactions, while Evri’s transactions jumped by 32% to 14.3 million.

- In 2023, 57.6% of all retail shopping (excluding groceries) was online

- Online sales increased from 25.4% in December 2022 to 27.1% in December 2023

- However, The proportion of sales made online fell to 24.8% in January 2024

From these statistics, we can group the data into key trends

Consumer spending adjustments

The cost of living crisis has put real pressure on businesses taking part in January sales, in an economy where consumers are really prioritising their spending. Surveys emphasise the public opinion of worry and apprehension surrounding Christmas spending. Overall data jumps are much less than in previous years. Many people have been choosing to cut back on Christmas food spending, with spending habits soon returning to normal in January time.

Value vs volume dynamics

The previous January sales saw a serious shift in the top prices people were willing to spend. Looking at the data, it seems that people are spending more money on fewer items, suggesting people are buying for luxury over quantity. However, it is more likely the surge in inflation is driving up prices, meaning consumers are paying more for fewer products than normal.

Sector-specific trends

If we are to presume that consumers are waiting for January sales to purchase those more high-end products, then this could also reflected in the sector-specific trends. November and December see huge increases in the clothing industry sales, especially around Black Friday. However, January sales seem to have little impact on boosting the clothing industry.

On the other hand, more expensive DIY tools for example in homeware stores, are more likely to be purchased in the January sales. This suggests consumers are waiting to use the January sales to purchase essential items they need anyway but at a lower price.

Product specific trends

Year after year, there are increasing trends in people using the January sales to purchase health and wellbeing products such as no-alcohol, or vegan alternatives. January sales are also increasingly being extended to gym memberships, fitness classes and meal subscription services.

User-generated content and influencer trends

Even if you thought you got everything you wanted for Christmas, the influencer hauls on social media will always make you want that next best thing. The rise of user-generated content, both organic and paid, has a serious impact on January sales consumer behaviour.

Influencer and businesswoman, Molly Mae has nearly 2 million YouTube subscribers and often shares what she has purchased over the Christmas season. This often leads her followers to also go and purchase the same/similar items, often in January sales.

Watch one of her Christmas Hauls below:

Summary

- Consumers are prioritizing essential purchases while cutting back on discretionary spending like clothing.

- There are preferences for health-conscious and ethical products (e.g., plant-based foods and no/low alcohol beverages)

- Inflation remains a key factor influencing spending habits

- There is a key difference emerging between volume and value growth

Want help with setting up January PPC campaigns? Do you have a question about how your SEO can impact January sales? Get in touch with us today!